- Objectively the Fed delaying its tapering is a very good thing.

- Treasury weakening has been delayed but also more potential weakening in the future granted.

- Emerging Markets (EMs) have been given a chance to get their house in order, but many will fail or ignore this opportunity.

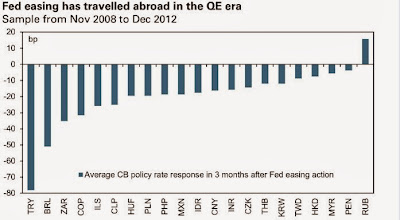

- EMs with current account deficits that have benefited over the last five years from QE (4trUS$ has flown into EMs in the previous 5 years) are at risk especially those that resist raising interest rates.

- We are bearish the TRY vs the US$ and expect to see 2.15-2.20 eventually.

________________________________________________________________________________________

A lot has been made of the postponement of tapering and we agree that it was a surprise for the markets in general, but we think an objective and strategic evaluation is necessary:

Tapering not having started is in fact a good thing as it reduces the probability of policy errors, thereby assuring that the underlying growth in the USA which we see via a lot of data points and forward looking indicators including a stronger housing sector, a 50% smaller current account deficit, stronger lending by banks especially to medium term enterprises, stronger manufacturing outlook including new orders as well as stronger PMI data. We also have to remember that the USA is currently being exposed to a very high fiscal headwind which approaches 1.5% of GDP for 2013. Given the headwinds will dissipate we expect the US to grow by around 2.5-3% in 2014.

Additionally, we are seeing further international supportive forces for US growth next year including a recovering Europe and the pricing out of tail risks to continue. The main risk of a Chinese slowdown has been averted this year due to yet more credit expansion (micro injections and management) by the centralised government. Although we believe that towards the end of 2014 China's growth rate will slow substantially, we are also aware that centralised governments can micro-manage and support an economy for much longer than people expect and hence we will get concerned about China only in the second half of next year or thereafter, if at all.

To summarise, tapering is assuring that the USA will continue to grow and that the slow anaemic growth rate will increasingly turn into a more sustainable expanding economy, helped by the stronger growth of its main trading partners. Indicators like the dry freight index, which has been quietly ticking up of late and trade volume figures are encouraging for global growth rates going forward.

The upshot of this is that a more gradual rise in the longer term rates in the USA will occur than with immediate tapering, but that the rise in rates will be longer and more sustainable. In fact, if Yellen does become the next Fed Chairwoman then we can expect her to err on the side of caution and allow for rates to stay lower for longer and allow for inflation to exceed its target of 2%. This would mean that inflation expectations would be allowed to rise during this time, and this will help to push longer term rates even higher than they would otherwise have been.

From a trading standpoint this implies that the rally in US Treasuries will actually give opportunities to enter/re-enter the market at phenomenal levels (especially if the debt ceiling turns into a problem next week) and for longer than expected. It will also mean that the target levels may have to be increased way above the 3.5% in the 10 year that we were envisioning. Tapering will occur, if not in October then by latest in Q1 2014. From an economic standpoint this is the better decision, though the Fed's communication skills are another issue for another day.

The above observations will also apply for other instruments that are dependent on real rate changes, like gold (we are still long term bearish of the yellow metal), but more about gold in our next note. Let us first look at what US monetary policy really means for other affected countries, which tend to be EMs. Please note our thanks to Ed Yardeni and Mauldin for their graphical inputs.

THE WIDER EFFECT OF TAPERING

In essence the efforts of communicating that tapering was coming, which began in May and the clear signals it gave to the markets were in essence a warning shot, a wake-up call especially to emerging markets that have large current account deficits, that have benefited the most from hot money inflows during the financial crisis years, where money was leaving the DMs and flowing into EMs. Countries like India and Turkey which fit that bill were under tremendous pressure over the last months and have only found solace in the announcement that tapering would be delayed.

The main point for those emerging markets is that this is an opportunity to get their house in order, to restructure their debt and increase interest rates, in order to firm their currency. This should be done even if that puts some pressure on growth rates, as this would be a gradual and relatively slow, easily digestible policy, which would assist in avoiding large FX moves, and a potential stampede of foreign capital out of those markets.

Some countries, like India seem to have started that process recently, whereas others are insisting that interest rate rises are unnecessary. The latter will see their currency under a lot of pressure going forward as capital has more and more places to be gainfully deployed including the US and EU. Hence EMs with large current account deficits and relatively low (especially the ones with negative real rates like Turkey) interest rates will see their currencies falter while their bond rates will appreciate. This will also not be a good environment for equities nor bonds in those countries. In the specific case of Turkey, it does remind us of days past, when another central bank tried to support its currency via interventions but found they did not have the reserves to do so and gave up in the end. I believe it was George Soros who benefited from that policy miscalculation...

Taking the example of the Turkish Lira, which has appreciated all the way to 1.93 from their 2.08 highs after the 'non-taper' announcement and is now weakening again against the major currencies, even the relatively weak US dollar: One has to ask the question what would change this weakening process over the future and barring drastic rate rises, which the central bank has excluded, only a very weak US$ would come to mind. The catch here is that the US$ is already very weak based on its trade-weighted index and if anything the postponement of tapering has assisted in weakening the US$ to levels that it would not have reached if tapering had commenced. When tapering does commence in earnest and effective real rates begin to rise in the USA before the other DMs we are going to see a strengthening in the US$ which will accerbate any weakening of the $-TRY rates.

From a trading standpoint this implies that we would want to be short of the TRY vs the US$ and increase our position straight after the debt and budget agreements have been struck, since those have the potential to weaken the US$ further in the short term. We expect the TRY to eventually weaken to the 2.15-2.20 levels.

Disclaimer: This report was prepared and distributed by Archbridge Capital AG, a company regulated by the Swiss Financial Market Supervisory Authority FINMA via VQF. The report was prepared and distributed for information purposes only. It contains information and opinions, which may be used as the basis for trading undertaken by Archbridge Capital AG and its officers, employees and related associates. The report should not be construed as solicitation nor as offering advice for the purposes of the purchase or sale of any asset, security or financial instrument or provide any investment advice or service, nor is it an official confirmation of terms. All information, opinions, estimates, forecasts, technical levels and valuations contained herein, are subject to change without notice. The report also contains information provided by third parties. Whilst Archbridge Capital AG has taken all reasonable steps to ensure this information is correct, Archbridge Capital AG does not offer any warranty as to the accuracy or completeness of such information. Any views or opinions expressed do not necessarily represent those of Archbridge Capital AG. The assets, securities and financial instruments discussed herein, may not be suitable for all investors, depending on individual needs, objectives and financial conditions. Any person placing reliance on the report to undertake trading does so entirely at their own risk and Archbridge Capital AG does not accept any liability whatsoever for any direct or indirect loss arising from any use of this material. You should be aware that returns can be volatile and you may lose all or a portion of your investment. Past performance of any investment or trading tool or strategy is not necessarily indicative of future performance or results. This information is not intended tax or legal advice. Unless otherwise stated, any pricing information given in this posting is indicative only, is subject to changes and does not constitute an offer to deal at any price quoted. As electronic publications are subject to alternations, Archbridge Capital AG shall not be liable for the improper transmission of this message, including the completion of information contained herein, the delay in its receipt, any possible interference, any possible damage to your system, or transmission of viruses.