- QE reduction is the start of tighter monetary policy in the US. Though we expect this tightening to be slower than the Fed forecasts, we do believe that this is only the beginning.

- Gold reacts badly to higher real interest rates and rates will rise for a long while yet.

- Any other potential driver for the Gold price is being reduced: safe haven, inflation, speculative interest and opportunity cost.

- We are bearish of gold in the long term. (We expect a bounce in the short term due to the market having over-reacted to QE tapering).

________________________________________________________________________________________

We have talked about Gold a number of times in our reports, let us quickly refresh our memories:

"Since QE is probably not going to be increased in the US it is reasonable to assume that real rates will begin to become positive over time and herewith ending the 10-year gold bull market. We, here at Archbridge Capital do believe that this will indeed occur and that rates will begin rising as we have discussed in "There is treasure in them Treasuries" Apr 4, 2013. We also believe that inflation will not pick up in the foreseeable future and hence we do expect that real rates in the forwards will begin to turn positive as the economies gradually strengthen. We would expect that gold does not see the previous highs in a very long time, perhaps even in this decade." from "Is there Method in the Market Madness?" April 23, 2013.

We have emphasised that gold's main driver is real interest rates and since we believed that interest rates had to rise in the USA we also believed that gold had to weaken as well as the US$ to strengthen. We stated this most explicitly in our report "A love supreme: The US$ is back" May 21, 2013 where we stated in our headline:

"For all the same reasons that the US$ will gain strength we should see pressure on gold".

We have also stressed that QE is a monetary mechanism by which real interest rates are effectively pushed to more and more negative levels, since nominal rates cannot go below zero. This has enable the Fed to create an environment where real interest rates were pushed to extremely negative levels in order to prevent an outright depression after the 2008/09 economic shock. Once this cash injection is being reduced the Fed is in effect raising real interest rates. This will have an ongoing negative impact on gold as we are only at the start of QE tapering. Over time QE will be ended and later the Fed will raise its interest rates - the longer term direction of gold seems clear!

A lot of readers and investors alike have asked us to write in more detail about gold and so we shall. Please note that all graphs below are with the courtesy of "Capital Economics", one of the best research houses available:

Quick recap of the gold story:

Gold has been rising substantially after the 2008 crisis, from around 800$ at the end of 2008 to nearly 2000$ in September 2011. During this time interest rates moved to 0.25% in the US and a massive QE programme was initiated, which grew finally to its current size of 85bn$ per month. With the inflation rate in a range of 1-2% throughout this period we saw real interest rates fall from substantially positive levels into very negative levels. To demonstrate just how negative real rates had become we must translate QE into monetary interest rate levels. This yields nominal rates of around -4.5%! This meant real rates were at a whopping -5.5 - -6%!

However, with QE injections planned to taper off gold has rightly plummeted substantially. In effect monetary policy is being tightened and hence we are seeing an instrument that is highly real interest rate sensitive reacting. The gold price fell from nearly 1700$ at the start of this year down to 1179$ at the end of June and nearly all of that since April 2013. A more than 30% fall since the start of the year.

However, please note that the average gold price in real terms ie. adjusted for US inflation since 1970 is just 730$ (we are still above the average). Also gold was trading around 800$ at the start of the crisis.

AVERAGE REAL GOLD PRICE SINCE 1970

Gold as an inflation hedge:

There is clear evidence of fading fears of inflation, which we can see in the breakeven inflation rates derived from US government bond prices. There are reasons to suspect that deflationary pressures will lurk for a while longer, since wage pressures seem subdued in general in the US, especially since the participation rates has dwindled. People have simply given up looking for jobs and may re-enter the job market once more jobs are available. Deflationary pressures are also being exerted via lower commodity prices worldwide due to a slower growing EM world including China. Additionally, Japan's monetary experiment, and other EM's whose currencies are weakening should drive their currency much lower over time exerting ever lower prices for its goods and services (imported deflation).

GOLD VS US 5 YR INFLATION

BREAKEVEN

Gold as safe haven:

Tail risks are being priced out of the market, with China engineering a gradual slowdown, rather than crashing. The Eurozone is showing signs of stabilisation and is in the midst of a 'bottoming-out' phase, rather than breaking up. Overall the world is in effect a safer place, which we can also see by the low volatility rates that have been prevalent pretty much throughout the year.

GOLD VS SPANISH 5 YR CDS

Gold's opportunity cost:

Talk of QE reduction has caused yields in the US 10-year to rise and with it real interest rates, as discussed above. Also note that the inverse relationship of gold and the US$ will increasingly prevail and assist gold's descent as we have mentioned in previous notes.

GOLD VS US 10 YR REAL YIELD

What next for Gold?

We believe that currently the announced schedule for QE tapering is probably too aggressive and that the end of QE will not be achieved before the end of 2014 at the earliest. The market has more than priced in what we believe to be a more realistic forecast. We cannot see the US economy recovering at the speed that the Fed is forecasting, especially given the Eurozone's longer than expected bottoming out period and China's engineered slowdown via the reduction of credit. Adding to this the EM slowdown story that is in progress and we cannot see the unemployment rate in the US getting reduced fast enough to meet the Fed's target rates, especially since a lot of the fall in unemployment occurred due to a fall in the participation rate. Hence we believe that gold will probably bounce to stronger levels from here in the short term.

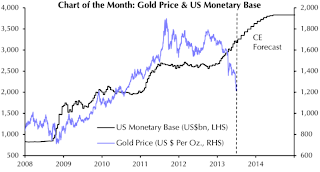

GOLD VS US MONETARY BASE

But let us be clear: We believe strongly that the process that is commencing via the tapering of QE is only a starting point and that we are going to see pressure on gold prices for a very long while into the future, until gold becomes as unimportant to the financial community and the world population as it once was before the crises. Hence we do see longer term gold prices reach pre-crisis levels and closer to its longer term average probably by the time the Fed tightens sometime within 2015.

Disclaimer: This report was prepared and distributed by Archbridge Capital AG, a company regulated by the Swiss Financial Market Supervisory Authority FINMA via VQF. The report was prepared and distributed for information purposes only. It contains information and opinions, which may be used as the basis for trading undertaken by Archbridge Capital AG and its officers, employees and related associates. The report should not be construed as solicitation nor as offering advice for the purposes of the purchase or sale of any asset, security or financial instrument or provide any investment advice or service, nor is it an official confirmation of terms. All information, opinions, estimates, forecasts, technical levels and valuations contained herein, are subject to change without notice. The report also contains information provided by third parties. Whilst Archbridge Capital AG has taken all reasonable steps to ensure this information is correct, Archbridge Capital AG does not offer any warranty as to the accuracy or completeness of such information. Any views or opinions expressed do not necessarily represent those of Archbridge Capital AG. The assets, securities and financial instruments discussed herein, may not be suitable for all investors, depending on individual needs, objectives and financial conditions. Any person placing reliance on the report to undertake trading does so entirely at their own risk and Archbridge Capital AG does not accept any liability whatsoever for any direct or indirect loss arising from any use of this material. You should be aware that returns can be volatile and you may lose all or a portion of your investment. Past performance of any investment or trading tool or strategy is not necessarily indicative of future performance or results. This information is not intended tax or legal advice. Unless otherwise stated, any pricing information given in this posting is indicative only, is subject to changes and does not constitute an offer to deal at any price quoted. As electronic publications are subject to alternations, Archbridge Capital AG shall not be liable for the improper transmission of this message, including the completion of information contained herein, the delay in its receipt, any possible interference, any possible damage to your system, or transmission of viruses.